Introduction: A Currency in Transition

Money, the lifeblood of modern economies, is undergoing a radical transformation. What began centuries ago as bartering and evolved into coins and paper currency is now moving toward a future dominated by digital wallets, decentralized ledgers, and algorithmic control. The future of money is not a far-off dream—it is happening now, reshaping how we earn, save, spend, and even understand value.

The Rise of Digital Currencies

Central banks and private enterprises around the world are racing to adopt digital currencies. Cryptocurrencies like Bitcoin and Ethereum have already challenged the hegemony of traditional financial systems. Meanwhile, governments are developing Central Bank Digital Currencies (CBDCs) to retain control over monetary policy in an increasingly decentralized financial world.

Digital currencies offer speed, security, and transparency. Transactions can be completed in seconds without the need for intermediaries like banks. They also provide financial inclusion for the unbanked, giving billions access to the global economy with just a smartphone.

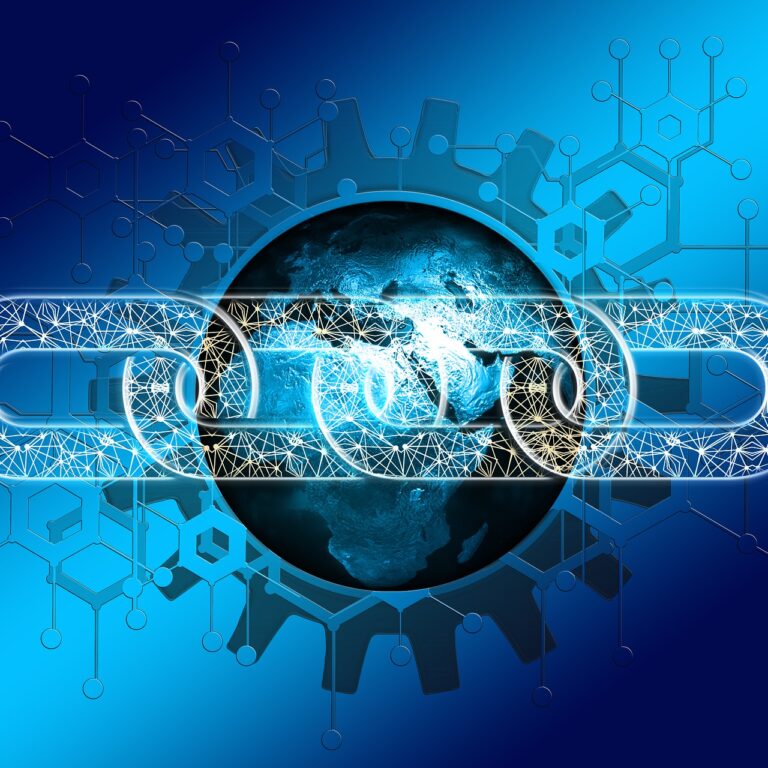

Blockchain: The Ledger of Trust

At the heart of this revolution lies blockchain technology—a decentralized, immutable ledger that records transactions across multiple systems. Blockchain doesn’t just power cryptocurrencies; it represents a new infrastructure for trust, transparency, and accountability. Whether it’s cross-border remittances, smart contracts, or secure voting systems, blockchain promises to reduce fraud and eliminate inefficiencies.

Cashless Societies: Convenience vs. Control

Countries like Sweden and China are moving rapidly toward becoming cashless societies. Mobile payments, contactless cards, and QR codes are becoming the norm. While this shift offers unprecedented convenience, it also raises serious concerns about surveillance and control. When every transaction is traceable, questions of privacy and freedom come into sharp focus.

As we digitize our economies, who holds the keys to our financial data? The answer will shape the balance of power in future societies.

AI and the Programmable Economy

Artificial Intelligence is poised to further revolutionize the financial world. From automated investing to predictive lending, AI is optimizing financial decision-making at both institutional and individual levels. The next evolution is “programmable money”—currency that executes commands based on pre-set conditions. Imagine money that can only be spent on certain items or expires after a certain period—governments and corporations alike are exploring these possibilities.

Financial Inclusion and the Global Divide

While the future of money holds promise, it also risks deepening existing inequalities. Access to the digital financial ecosystem is still limited by infrastructure, education, and trust. Bridging this digital divide is critical if the benefits of the new economy are to be shared equitably.

Governments, NGOs, and private innovators must collaborate to ensure no one is left behind in the transition.

Conclusion: Redefining Wealth and Value

The future of money is more than just a technological upgrade—it is a cultural, social, and economic transformation. It will redefine what we consider wealth, how we exchange value, and even how we govern ourselves. As we move from paper to pixels, we must navigate this evolution with foresight, ethics, and inclusion at the forefront.

The age of digital money is here. The question is—are we ready?

Your prose resonates like a distant melody, familiar yet fresh, awakening memory, insight, and contemplation. Each phrase encourages reflection, mindful attention, and a profound appreciation of nuance and subtle emotional depth.